Considering Invisalign? Before you commit, it’s important to know who’s really responsible for your treatment—and why the provider matters more than the brand. This guide explains the difference between board-certified orthodontists who offer Invisalign as part of their specialized care and general Invisalign providers who are not trained orthodontic specialists. Understanding who’s planning your treatment is the key to achieving safe, long-lasting results.

Expert Guidance from Board-Certified Orthodontist and UCLA Clinical Faculty, Dr. Amir Assefnia

Q: Who’s Really Behind That Invisalign Plan? Here’s What They Don’t Advertise

You’ve probably seen Invisalign advertised online or at your dentist’s office. It’s sleek, discreet, and promises straight teeth without braces.

But here’s what many people don’t realize:

Invisalign is just a tool—the results depend entirely on the doctor behind it. It’s the doctor who plans your teeth movements, designs your treatment, and guides your progress. In other words, the outcome isn’t about the brand—it’s about the expertise behind the plan. Choose the right doctor, and the results will follow.

Before starting Invisalign or other clear aligner treatment, it’s essential to understand who is qualified to move your teeth—and why that matters.

Q: What Is Invisalign and Who Makes It?

Invisalign is a brand of clear aligners made by Align Technology, a U.S.-based company. These clear trays are designed to gradually shift your teeth into position.

But here’s the key detail:

Align Technology only manufactures the trays—they do not plan your treatment without a doctor diagnosis, evaluate your bite, or guarantee your results. It is the doctor who is responsible for proper diagnosis, creating and implementing your treatment plan

As a result, it is very important to make sure that your provider has the necessary education and training for diagnosing your issues and are able to create a reliable and dependable treatment plan.

Q: Does Invisalign Monitor or Guarantee My Treatment?

No. Invisalign (Align Technology) does not monitor or assume any responsibility or guarantee of your outcome. They simply manufacture trays based on what your provider submits. That’s why the training and qualifications of your provider are critical.

Q: What Do Invisalign Diamond, Platinum, or Gold Provider Levels Really Mean?

These labels—like Diamond, Platinum, or Gold—were created by Align Technology (the company behind Invisalign) to recognize providers based on volume of cases—not skill or treatment outcomes. In some scenarios, large practices combine multiple office locations, or multiple providers in the same practice to boost their case count and their badge label— but that doesn’t necessarily mean you’re getting specialist-level care.

- Think of them as marketing designations, not medical or dental credentials.

- These labels are not medical or dental certifications, and they don’t reflect the quality of a provider’s training, experience in complex cases, or patient outcomes.

- In fact, these titles aren’t recognized or used by any official dental or orthodontic boards, and they hold no weight in scientific or academic communities.

- If you’re looking for the highest standard of orthodontic treatment, choose a board-certified orthodontist—a specialist who has attended additional years of orthodontic residency and passed rigorous exams and are truly certified to address tooth movement, jaw and bite correction.

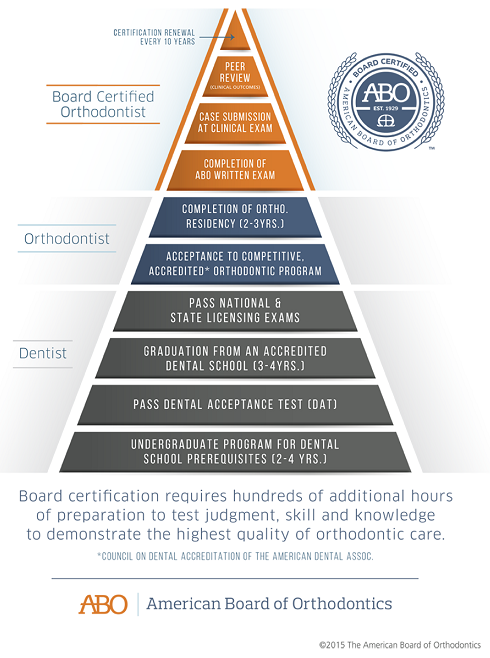

Q: What doctor has the right credentials to truly diagnose my bite, jaw, teeth misalignment issues? Dentist or Orthodontist?

Orthodontists are the only dental professionals who receive formal, specialized training in tooth movement, bite correction, and jaw alignment. After dental school, they complete an additional 2–3 years of intensive orthodontic residency, where they focus exclusively on diagnosing and treating alignment and bite issues.

Orthodontic residency is highly competitive—only a select group of top applicants are accepted each year based on rigorous academic and clinical qualifications.

At Super Orthodontics, Dr. Amir Assefnia is not only a board-certified orthodontist—he earned a 99th percentile score on the National Board Dental Examination(NDBE), the highest score possible and an achievement reached by only a rare few in the history of the exam.

This level of accomplishment reflects both his dedication and his deep understanding of orthodontic science.

Q: What Questions Should I Ask My Invisalign Provider?

Before you start Invisalign or any clear aligner treatment, ask:

- What’s your diagnosis of my bite and teeth alignment?

- Can you explain my treatment plan—and why each step is necessary?

- Are you a board-certified orthodontist or a general dentist?

- Where did you receive your orthodontic training?

- Who will oversee my case, and how often will I be monitored?

- What risks are there if my bite isn’t corrected properly?

These questions help you determine whether your provider has the expertise to deliver safe, stable, and beautiful results.

“Only an orthodontist has the additional training and experience to diagnose and treat alignment and bite issues correctly.”

— American Dental Association (ADA)

Q: Why Choose Super Orthodontics for Your Orthodontic Treatment?

Dr. Amir Assefnia is a Board-Certified Orthodontist, clinical faculty at UCLA, and one of the highest-ranked Orthodontists nationwide. With years of advanced training and a deep commitment to excellence, Dr. Amir Assefnia has successfully treated thousands of children, teens, and adults throughout his career. His expertise spans everything from early intervention pediatric orthodontics to complex bite and jaw correction for all ages, and his compassionate, patient-centered approach has earned him the trust of families and referring dentists alike.

Patients across Encino, Los Angeles, and the San Fernando Valley trust him for his honest and high-quality care, his exceptional academic and clinical background, and his leadership in adopting the most advanced orthodontic technologies. Dr. Amir Assefnia is recognized not only for delivering outstanding results but also for making treatment faster, more comfortable, and more precise for every patient.

At Super Orthodontics, we offer personalized orthodontic care designed to meet your specific needs. Schedule your consultation with Dr. Amir Assefnia today and take the first step toward achieving a healthier more confident smile.

Final Word: Choose a Board-Certified Orthodontist—Not Just Any Dentist

Invisalign and other aligners can absolutely create beautiful smiles—but only when treatment is guided by a trained expert.

The brand you choose matters less than the person behind the plan. Avoid relying on status labels or flashy ads. Instead, choose a provider who has the specialized education, credentials, and attention to detail your smile deserves.

Orthodontic treatment is an investment in your long-term health, function, and confidence. You only get one smile—make sure it’s in the right hands.

If you’re looking for a trusted, experienced board-certified orthodontist, come see us at Super Orthodontics. At Super Orthodontics in Encino, Los Angeles, CA, we don’t just straighten teeth—we transform lives by creating beautiful, healthy, stable smiles that last a lifetime.

Smiles That Speak for Themselves

Hear From Our Happy Patients!

Dr. Assefnia is a top-notch clinical orthodontist with a big heart and superb service! Unlike him, most dentists act like businessmen. Their contract is simple and straightforward without any high-pressured sales pitch or intention to deceive or to pressure you to sign. Their office is so clean that you could literally eat off the floor. Definitely consider getting a consult here especially with free parking. He truly cares about his patients. He takes into account of all the important clinical information about his patients when creating their treatment plan. I had taken my sons to get many consults, and he was the only orthodontist who took notice of and inquired about my son’s epilepsy that I had noted on the new patient intake form.

As a general dentist and a mom when my 8 years old son needed braces, I trusted Dr Amir with his care. My son went thru phase one with Dr Amir. Every visit was fun and my son looked forward in seeing him. Dr Amir is very kind and has a great sense of humor . We had a fantastic experience and Results were excellent! He is forever my family orthodontist!

Best orthodontist! Great “bedside manner” Dr. Amir explains everything very well and gives us time to ask questions. Dr Amir treated both my kids and myself on our braces journey, and he made it pleasant and comfortable as can be. Thank you, Dr. Amir, for giving us a great smile! I would highly recommend Dr. Amir.